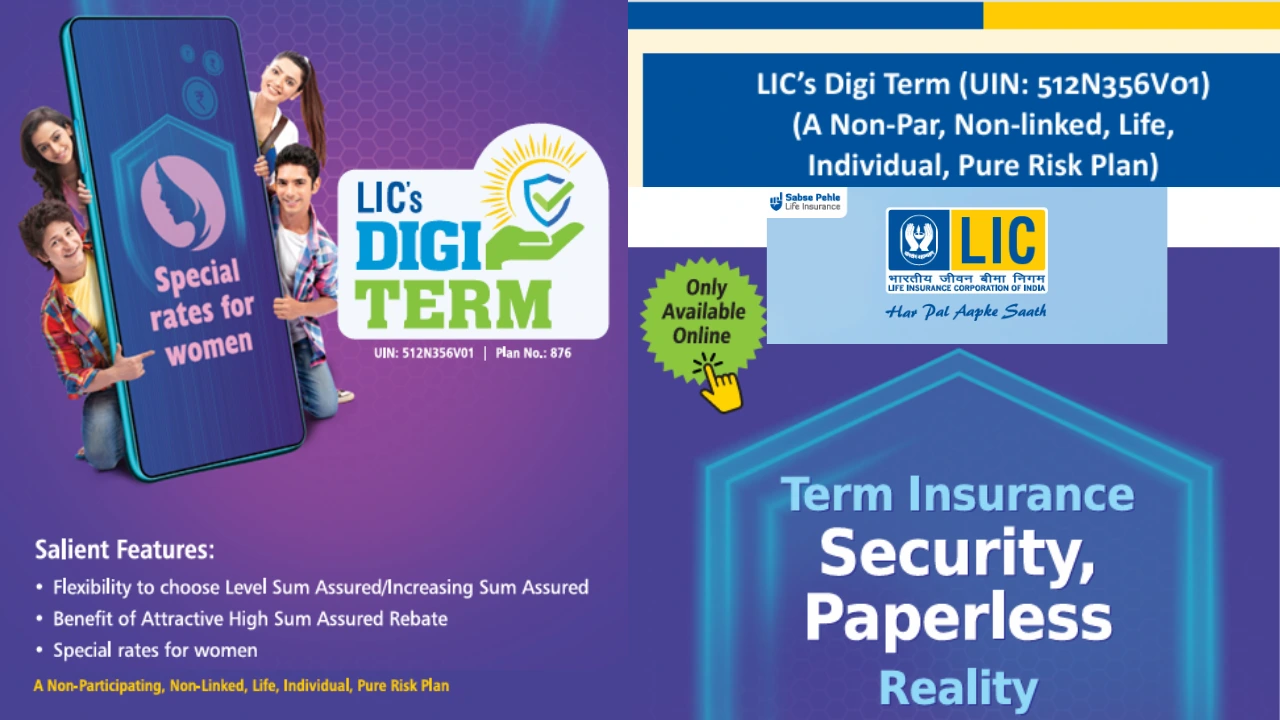

The LIC Digi Term Plan is a non-participating, non-linked, pure risk life insurance plan designed to provide financial security to the insured’s family in case of an unfortunate demise. With flexibility in premium payment, policy term, and death benefit options, this plan offers an ideal solution for individuals seeking comprehensive protection.

Key Features of LIC Digi Term

- Death Benefit Options:

- Level Sum Assured: Fixed sum assured throughout the policy term.

- Increasing Sum Assured: Sum assured increases by 10% every year after the fifth policy year, up to double the basic sum assured.

- Flexible Premium Payment:

- Choose between Regular Premium, Limited Premium (10 or 15 years), and Single Premium options.

- Policy Term:

- Regular/Single Premium: 15–40 years.

- Limited Premium: 20–40 years (15-year payment term).

- Special Benefits:

- Special premium rates for women.

- Attractive rebates for high sum assured.

- Separate premium rates for smokers and non-smokers based on medical tests.

- Additional Features:

- Option to receive the death benefit in installments (5, 10, or 15 years).

- Minimum sum assured: ₹50,00,000.

- Maximum sum assured: ₹5,00,00,000 or higher (based on underwriting decisions).

Eligibility Criteria in LIC Digi Term

- Minimum Entry Age: 18 years.

- Maximum Entry Age: 45 years.

- Policy Term: 15 to 40 years.

- Premium Amount: Starts at ₹3,000 for Regular/Limited Premium and ₹30,000 for Single Premium.

Benefits of LIC Digi Term

- Death Benefit:

- Paid to the nominee in case of the insured’s demise during the policy term.

- The amount is based on the death benefit option chosen and premium type.

- No Maturity Benefit:

- This is a pure risk plan; no benefits are paid on survival.

- Grace Period:

- A 30-day grace period for premium payments under Regular and Limited Premium options.

- Tax Benefits:

- Premiums paid may qualify for tax deductions under Section 80C.

Related Article-LIC Jeevan Utsav Plan 2025: Your Gateway to Guaranteed Financial Security and Flexibility

FAQs About LIC Digi Term Plan

1. What is the premium amount for a ₹50,00,000 sum assured in LIC Digi Term?

- For a 20-year policy, a 30-year-old male non-smoker pays approximately ₹4,700 annually for the Level Sum Assured option.

2. Can the death benefit option be changed later?

- No, the death benefit option must be selected at policy inception and cannot be modified later.

3. What happens if I miss a premium payment?

- A grace period of 30 days is provided. If the premium is not paid within this period, the policy lapses but can be revived within five years.

4. Are there any surrender benefits in LIC Digi Term?

- Surrender benefits are available only for Single Premium or Limited Premium policies after three full years of premium payment.

5. Can I take a loan against LIC Digi Term policy?

- No, loans are not available under this plan.

6. Is there any exclusion for suicide in LIC Digi Term policy?

- Yes, if the insured commits suicide within 12 months of policy inception or revival, the nominee is entitled to 80% of the total premiums paid.

Why Choose LIC Digi Term?

LIC Digi Term offers a robust and flexible life insurance solution, ensuring financial stability for your family. With competitive rates, customization options, and reliable service, this plan caters to diverse protection needs while maintaining simplicity and transparency.

Disclamer-For more details, visit the LIC India website or contact your nearest LIC branch.

1 thought on “LIC Digi Term Plan in 2025: Affordable Life Insurance with Flexible Benefits Explained!”